はじめてのFXなら外為どっとコム

初心者から上級者まで

外為どっとコムが選ばれる理由

-

低コストの手数料・

取引単位 -

基礎から学べる

FX知識・セミナー -

安心・充実の

サポート体制 -

はじめてのFXに

最適なスマホアプリ -

業界最狭水準

スプレッド -

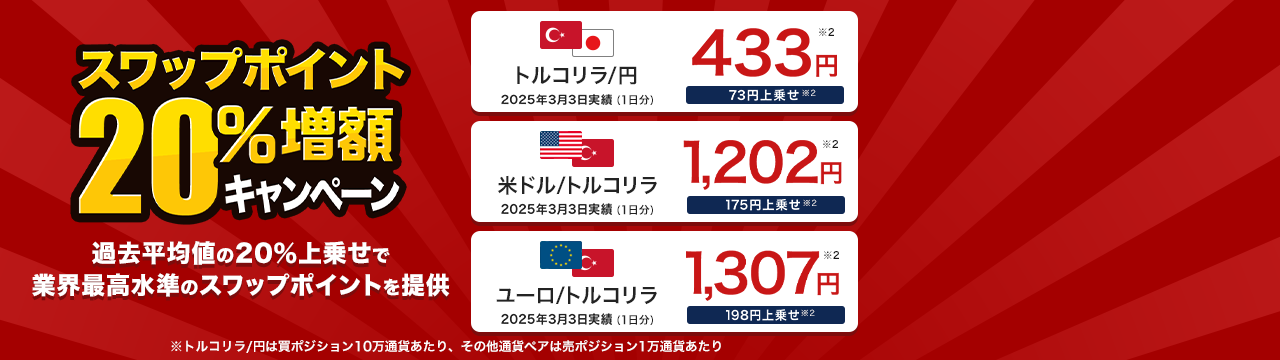

スワップ高水準の

高金利通貨 -

充実の会員様向け

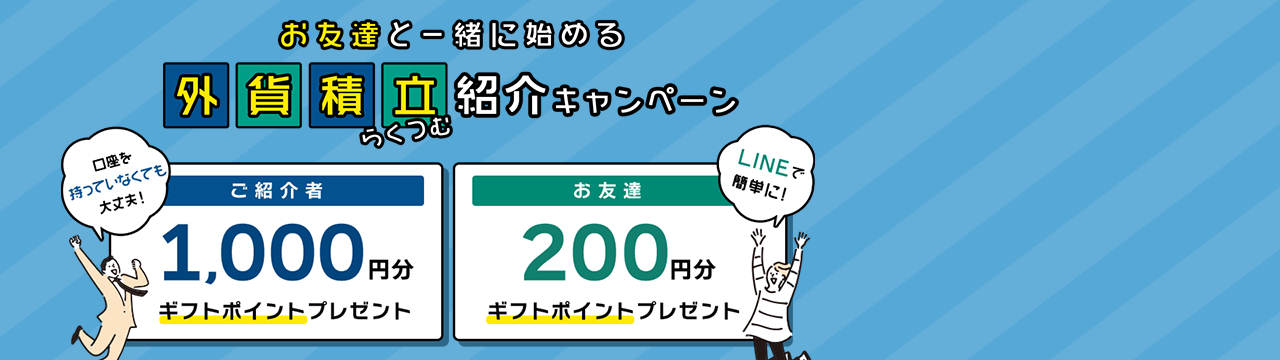

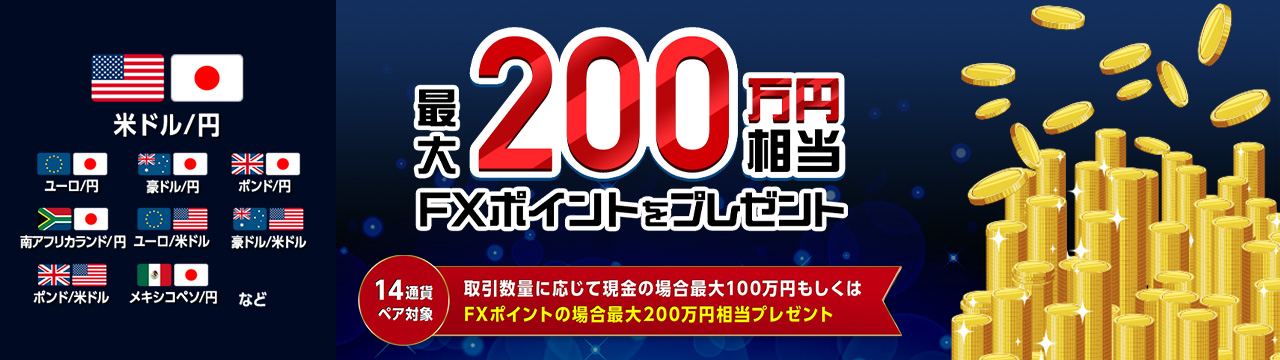

キャンペーン -

取引機会を逃さない

マーケット情報

※買ポジション10万通貨あたり2024年3月適用分平均値

口座開設の流れ

「スマホで本人確認」を利用して申し込みを行えば、最短当日でお取引がスタートできます!※

-

フォーム入力 スマートフォンまたはPCから

本人情報をご入力ください。 -

本人確認書類の

提出お手元にマイナンバーと

本人確認書類をご用意いただければ、

PCからお手続きいただく方も、

スマートフォンを利用して

オンラインで本人確認が行えます。 -

口座開設完了 最短当日でお取引がスタートできます!

外為どっとコムのマーケット情報も

参考にして各種お取引を行えます。

新規口座開設でキャッシュバック

無料で口座開設

※ 法人のお客様を除きます。

また、日数はあくまで最短の目安であり、土日/一部の祝日を含む場合、提出いただいた書類に不備がある場合、

お客様の住まいの地域などにより異なります。詳しい手順はこちらをご確認ください。